A client sent us a link to a Times article yesterday. This is a client who's hoping to sell their house and this article paints none-too-pretty a picture. Give it a gander. Then come back to your favorite real estate blog and read below for my response to our client. (Reproduced with their permission, of course.)

"Interesting article. The two things I think the writer gets right are:

1. The illiquid real estate market is stagnating

2. The “shadow inventory” being a real issue

"In a more liquid market, prices drop rapidly until the market “reaches” the buyers. In real estate, prices tend to fall more slowly. The thing people forgot in the past decade is that real estate is fundamentally a long term, illiquid investment. You can’t just wake up one morning and decide to sell your property, as if it were stock in IBM. Admittedly, it seemed that way for a long time, but that’s not a normal reality for real estate. The liquidity of the market was, in part, a function of the liquidity of the mortgage market. Now that the mortgage market is tighter, so is the real estate market. Seems obvious, but we all sort of lost sight of this.

"I actually addressed the “shadow” market in a recent mailing. This is my biggest concern about the future, though it may come to nothing. There’s hard data (something not heavily embraced by the writer of the article) that says that the banks are holding back foreclosure inventory to prevent a flood on the market that would drive values down. In one sense, this is very troubling. Part of me wants to just let the bank-owned (REO) inventory sell off so we can see where we really stand, even if it means driving prices down; like letting a wildfire burn off all of the underbrush to allow for new growth. It might be painful, but at least it would be over. In another sense, it’s very reassuring. As long as the banks maintain this approach, property values should be somewhat protected. We might be able to pull the Band Aid off slowly enough that we hardly notice how much it hurts. (Excuse the mixed metaphor.) By all accounts, the banks learned their lesson in early 2009 when they released too much REO inventory at once and cannibalized their own market. Regardless, the shadow inventory makes people nervous, and for legitimate reasons.

"There is a doom and gloom school of thought that says that we have years to go before we hit bottom. This is clearly the point of view of the writer. Fair enough. Indeed, the notion that a 3 bedroom, 2 bath house ought to sell for $800,000, regardless of where it’s located, is, on its face, a little ridiculous. You could build a house for half that price. But this premise is built on a willingness to throw out decades of economic history. From 1970 to 2006, the median price of a home in Marin County went up every year, except for 1990 and 1991. Suddenly the price of a Marin County home is supposed to drop by 300%? I suppose anything is possible, but this seems unlikely unless a full scale reassessment of our economy is in process. And if you believe that prices will fall significantly further over the coming years, then that argues for selling now, while you can still get somewhat close to the top of the market.

"I am far from a glass-half-full person by nature. In fact, I tend to be a worst-case-scenario person. I willingly admit that things could get worse before they get better. But I think it’s worth noting that the writer’s source for the opinion that the price of an $800,000 home in the Bay Area is “unrealistically high” is a “blogger”; not an economist. (I have a blog, too, but I don’t expect to be quoted in the Times.) I’m cautiously optimistic about the market. In fact, I plan to invest myself in the next 12 months. These kinds of articles always smack of the blame game to me. It is popular to blast Realtors or NAR as being a false engine driving an unrealistic real estate market. It’s a fair critique, but one that’s based primarily in opinion, not fact. It’s a kneejerk reaction, like blaming SUV drivers for the war in Iraq; there may be a residue of truth to it, but certainly the real story is more complex. (Should we blame Best Buy when someone replaces a perfectly good, eight year-old television with a new 50” HD flat screen that they can barely afford?) There is very little actual data in the article. I don’t necessarily disagree with its premise, but I’m not sure I like its methodology.

"For whatever it’s worth ( I’d have to check to be sure), I think I’ve worked on more transactions in the past 12 months than in any previous 12 month period over the past five years. The point? Houses are still selling. Buyers are still buying. Lenders are still lending. I guess I question somewhat the motivation of the writer of the article. I agree that there’s plenty of bad news out there. We can all throw our hands up and decide that the sky is falling. Or we can put our nose back to the ground, get to work, and see if we can solve this."

Sunday, August 29, 2010

Thursday, August 19, 2010

Old School, New School, Bad School?

It's a dilmma for every San Francisco parent (and the source of a huge percentage of our Marin County referrals). What are parents of school-age kids to do? Contrary to popular opinion, most parents we know would love to send their children to public school in San Francisco. The problem? 0 for 7. For the uninitiated, o for 7 has become scary shorthand for being assigned to a kindergarten that was not among any of parents' top seven choices. Say "0 for 7" to almost any parent in the City and prepare to hear a rant.

Today's Chron features an article that hightlights the issue. Recent reforms may address some of the problems. But we're guessing the rants will continue.

Today's Chron features an article that hightlights the issue. Recent reforms may address some of the problems. But we're guessing the rants will continue.

Tuesday, August 10, 2010

Numbers Don't Lie (but they may fib a little bit)

"Economix," a blog that appears on NYTimes.com, can be an interesting read for those curious about a more scientific approach to the national real estate market. Today's post by Harvard economist Edward Glaeser, looks at hard data for mortgage approval rates and loan-to-value ratios. The findings are inconclusive. In short, approval rates and LTV ratios were not significantly different during the real estate boom than they were in the years before. Statistical analysis, of course, is designed to take anecdotal observation out of the equation or even, as in this case, conventional wisdom. From a Realtor's perspective, this is a little like looking at a barometer to tell you when it's raining. Most of us would just walk outside and see if we got wet. Nevertheless, it's interesting to see that the data does not necessarily bear out what we might expect. The truth, as always, lies somewhere in the middle.

A previous entry in the blog tells us that housing prices peaked in May, 2006. This is a nationwide measure. Our considered, Marin-and-San-Francisco-centric opinion, is that our local markets first faltered in September, 2007. It would be reasonable that the boom in these areas would last longer than the nation's s a whole, due to more favorable economic factors and the relative lack of new construction. Why do we pick September, 2007? Because that was the month when we first heard about Jumbo mortgages failing to fund. This is a strictly anecdotal, but, we believe, entirely accurate conclusion.

We find it useful to compare local market observations and national market data to help inform our understanding of where we were, how we got there, and where we're going. If you are a Times or WSJ reader who tends to get caught up in national or even statewide statistics, remember there are always stories closer to home that may paint a different picture. And we're always happy to tell them.

A previous entry in the blog tells us that housing prices peaked in May, 2006. This is a nationwide measure. Our considered, Marin-and-San-Francisco-centric opinion, is that our local markets first faltered in September, 2007. It would be reasonable that the boom in these areas would last longer than the nation's s a whole, due to more favorable economic factors and the relative lack of new construction. Why do we pick September, 2007? Because that was the month when we first heard about Jumbo mortgages failing to fund. This is a strictly anecdotal, but, we believe, entirely accurate conclusion.

We find it useful to compare local market observations and national market data to help inform our understanding of where we were, how we got there, and where we're going. If you are a Times or WSJ reader who tends to get caught up in national or even statewide statistics, remember there are always stories closer to home that may paint a different picture. And we're always happy to tell them.

Sunday, August 1, 2010

Second to One?

There are so many reasons not to buy foreclosure properties at auction, it's hard to know where to begin. Want to know just a few reasons, check out this article from the SF Chron on one family's unfortunate trip to the courthouse steps.

Tuesday, July 20, 2010

The More Things Change...

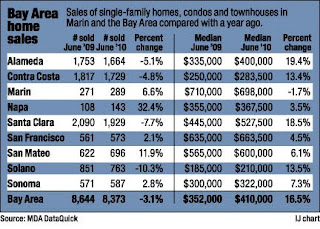

These days, no news seems like the best news when it comes to the real estate market. And no news is just what we got last week when the June median home price for Marin County came in virtually unchanged from 2009. In an odd sort of way, this jibes with what we've been experiencing on the street. Sellers have been saying, "It sure seems like prices have gone up this year." (Hopeful thinking.) While buyers keep telling us, "I think the market is still going down." (More hopeful thinking.) It would appear that, as usual, the truth lies somewhere in the middle.

If you're looking for the glass-half-full take on the data, it's this...The number of units sold was up over 6% while the median price stayed nearly flat. Why is this news? Because until recently, the only thing that drove unit sales was falling prices. An upturn in activity without a corresponding decline in values is, in our opinion, an indicator of a market that's finding it's footing. And that's probably good news for everyone.

If you're looking for the glass-half-full take on the data, it's this...The number of units sold was up over 6% while the median price stayed nearly flat. Why is this news? Because until recently, the only thing that drove unit sales was falling prices. An upturn in activity without a corresponding decline in values is, in our opinion, an indicator of a market that's finding it's footing. And that's probably good news for everyone.

Tuesday, June 1, 2010

Fuel for the Fire?

In nature, they say that wildfires and forest fires are part of the natural cycle. They clean out the dead and dying vegetation in one violent burn and set seed for a whole new generation of growth. Sure, it can be terrifying to watch as thousands of acres burn, but it may just be what mother nature ordered. In fact, sometimes the best choice is to just let the fire burn itself out until all the fuel is used up.

Of course, the issue gets cloudier when we find out that a fire wasn't started by a random lightning strike or other natural spark. We tend to feel differently when we find out that human negligence was involved. A cigarette butt tossed out a window or a camp fire left untended. When a fire was set deliberately by some nefarious individual, we may even be furious. And when that fire burns houses instead of mere trees and brush, we become enraged.

Which brings is to another buried lead in this article from sfgate.com. While it is certainly notable that the upper end of the market is feeling the foreclosure pinch, more interesting is the acknowledgement that banks are holding back REO inventory to prevent a freefall in property values. If you're a buyer looking for a bargain, you may find this irritating. If you're a pure free marketer, you may find it manipulative. But if you would prefer to see property values stay within shouting distance of where they were a few years ago, this doesn't seem like the worst strategy. Sure, it's in the banks' interest, since they're sitting on more real estate than they ever expected to own. But it's not necessarily bad for regular Joes or Joans who own just one or two properties and would prefer not to see those values decline even further.

How does this relate to a forest fire? The first question is, are we better off just letting this one burn itself out. Are bank-owned properties just so much fuel for the fire and does the long term health of our real estate forest depend on letting that fuel get used up in one massive inferno. (Forgive the belabored metaphor.) Or should should we control this burn and even try to put it out. And does it change the way you answer when you factor in the notion that human greed, negligence, and (cue the conspiracy theories) intent may have been the spark that started the blaze. Where do you stand?

Of course, the issue gets cloudier when we find out that a fire wasn't started by a random lightning strike or other natural spark. We tend to feel differently when we find out that human negligence was involved. A cigarette butt tossed out a window or a camp fire left untended. When a fire was set deliberately by some nefarious individual, we may even be furious. And when that fire burns houses instead of mere trees and brush, we become enraged.

Which brings is to another buried lead in this article from sfgate.com. While it is certainly notable that the upper end of the market is feeling the foreclosure pinch, more interesting is the acknowledgement that banks are holding back REO inventory to prevent a freefall in property values. If you're a buyer looking for a bargain, you may find this irritating. If you're a pure free marketer, you may find it manipulative. But if you would prefer to see property values stay within shouting distance of where they were a few years ago, this doesn't seem like the worst strategy. Sure, it's in the banks' interest, since they're sitting on more real estate than they ever expected to own. But it's not necessarily bad for regular Joes or Joans who own just one or two properties and would prefer not to see those values decline even further.

How does this relate to a forest fire? The first question is, are we better off just letting this one burn itself out. Are bank-owned properties just so much fuel for the fire and does the long term health of our real estate forest depend on letting that fuel get used up in one massive inferno. (Forgive the belabored metaphor.) Or should should we control this burn and even try to put it out. And does it change the way you answer when you factor in the notion that human greed, negligence, and (cue the conspiracy theories) intent may have been the spark that started the blaze. Where do you stand?

Friday, May 28, 2010

A Leg...Sideways?

Until about three years ago, home ownership seemed like the key to a better life for nearly every American. A first step up the financial ladder. And even before risky loans and reckless borrowing brought the dream to its knees, a more honorable approach to first-time home buying emerged in the form of "Below Market Rate" housing. Cities and counties throughout California began requiring that developers set aside a certain portion of new housing units in a particular development to be included in BMR programs that would allow people to own real estate who would ordinarily never have been able to afford it.

Sounds like a noble endeavor all the way around.

So check out this article in the Marin IJ. It's nominally about how the financial crisis is forcing counties to revisit how they handle these BMR programs and how this is causing an uproar among buyers of regular market rate units in those developments. The buried lead, however, can be found in paragraph three: Buyers of BMR units "must sell them at about the same price they purchased them for."

Forget for a moment that there's a financial crisis going on. Pretend it's business as usual in the world of real estate. Can anyone explain how a BMR program is supposed to help someone get a leg up in the world if the appreciation potential of the investment is essentially nil. We're not economists, but this has troubled and confused us for years. SF has a similar program and it's never made sense to us. Shouldn't BMR units at least be able to appreciate at rates similar to comparable unit in the development? Otherwise, what's the point? All the headaches of homeownership (repairs, maintenance or HOA dues) with hardly any of the financial benefits?

We welcome your thoughts on this. It's something we've wondered about for years.

Sounds like a noble endeavor all the way around.

So check out this article in the Marin IJ. It's nominally about how the financial crisis is forcing counties to revisit how they handle these BMR programs and how this is causing an uproar among buyers of regular market rate units in those developments. The buried lead, however, can be found in paragraph three: Buyers of BMR units "must sell them at about the same price they purchased them for."

Forget for a moment that there's a financial crisis going on. Pretend it's business as usual in the world of real estate. Can anyone explain how a BMR program is supposed to help someone get a leg up in the world if the appreciation potential of the investment is essentially nil. We're not economists, but this has troubled and confused us for years. SF has a similar program and it's never made sense to us. Shouldn't BMR units at least be able to appreciate at rates similar to comparable unit in the development? Otherwise, what's the point? All the headaches of homeownership (repairs, maintenance or HOA dues) with hardly any of the financial benefits?

We welcome your thoughts on this. It's something we've wondered about for years.

Sunday, May 16, 2010

Enough is enough?

Scroll down to the real eastate-related blub in this nugget from the Bloomberg Report in today's Chron. It will come as a surpirse to many in the Bay Area to hear that foreclosures show no sign of letting up. It's nice to see the notices of default are down a tad, but that doesn't mean much for those looking a present problems (or opportunities). To us, this is a reminder that, while the recovery does appear to be fully on, it is still likely to be slow and fitful. We read recently that real estate prices aren't expected to return to their pre-downturn levels for another five years. Taking the temperature of our local markets, that feels about right.

Thursday, April 15, 2010

Skipping Along the Bottom?

Today's article in the Chron may be the first evidence that the bottom of the market may be in the rearview mirrow. Maybe. We're inclined to wait a month or three to see whether we're just skipping along the bottom or actually bouncing off it.

Friday, April 9, 2010

Shameless Plug

We try to make this space informative and entertaining, but that doesn't mean we can't promote our listings every once in a while.

Here's our latest and greatest.

6033 Shelter Bay Ave., Mill Valley

317 29th St. #203, SF

290 Nevada St., SF

2248 15th St., SF

And while we're at it, we represented the buyers of this lovely Mill Valley home:

83 Sunnyside Ave., MV

Here's our latest and greatest.

6033 Shelter Bay Ave., Mill Valley

317 29th St. #203, SF

290 Nevada St., SF

2248 15th St., SF

And while we're at it, we represented the buyers of this lovely Mill Valley home:

83 Sunnyside Ave., MV

Music To Our Ears

We're on vacation, but this item in the IJ didn't escape our notice. Longtime readers of this blog who remember our tribute to Charlie Deal know that we've got a soft spot for the old Mill Valley. It appears that some of what made our home town great may be making a comeback. We say, welcome back!

Wednesday, March 31, 2010

Rate of Return

We suppose there's a way to interpret this as something other than good news, but we sure can't think of one. Right now, low mortgage rates are just the thing to keep both buyers and sellers happy. Here's hoping...

Sunday, March 21, 2010

Welcome to the Neigborhood

We've been touting the evolving Divisidero corridor for a couple of year now. It may still be a bit gritty for some folks, but the neighborhood has vitality and genuine diversity more reminiscent of Brooklyn than the Mission district. From a real estate perspective, we think values already reflect the area's future more than its past. In other words, it's probably too late to bet on the come. But if your goal is to live in an exciting, vibrant, true urban neighborhood with decent weather and access to Golden Gate Park, you'd be hard pressed to do better. So the next time you're cursing the traffic as you travel from the Marina to Noe Valley, consider just parking the car and walking. You may be pleasantly surprised by what you find.

Monday, March 15, 2010

Taxing Situation

Most people don't realize that there can be tax consequences to a short sale. Just when you think you've gotten out from under an unfortunate financial situation, you may find that you have a substantial tax bill. Today's Chron article spells out the pitfalls that may sellers are completely unaware of.

Labels:

Short sales,

taxes

Wednesday, March 10, 2010

School of Thought

If you aren't raising children in San Francisco, this story might not seem like a big deal. But if you or someone you know has young 'uns in Baghdad by the Bay, then you know that the public school selection process is one of the single most important issues in town.

What's the real estate connection? The school board's decision to grant partial neighborhood preference could well have some impact on property values for homes near the most desirable schools. Of course, if the board had granted full neighborhood preference, the impact would have been huge.

In Marin, schools are a driving force behind property values. In San Francisco, schools are often a driving force behind people moving to Marin. Will the board's decision stem this tide? Time will tell. Did the board's decision only serve to further segregate SF's public school or did they not go far enough? We'd love to hear readers' thoughts (real estate-related or otherwise) on this very divisive issue.

What's the real estate connection? The school board's decision to grant partial neighborhood preference could well have some impact on property values for homes near the most desirable schools. Of course, if the board had granted full neighborhood preference, the impact would have been huge.

In Marin, schools are a driving force behind property values. In San Francisco, schools are often a driving force behind people moving to Marin. Will the board's decision stem this tide? Time will tell. Did the board's decision only serve to further segregate SF's public school or did they not go far enough? We'd love to hear readers' thoughts (real estate-related or otherwise) on this very divisive issue.

Labels:

san francisco,

San Francisco real estate,

schools

Monday, March 8, 2010

Helping or Hurting?

Missed this one a few weeks ago, but it's worth a trip back in time. New appraisal guidelines are making it harder than ever to get financing for a home purchase. These days, anti-reform and anti-regulation stances are less popular than ever, but reform for reform's sake can backfire.

In our sphere, we've heard innumerable stories of local appraisals being done by out-of-area appraisers. (Mill Valley house, Sacramento appraiser. San Francisco condo, Morgan Hill appraiser.) We talk often about the importance of working with a Realtor who really understands a local market. Well, that wisdom gets severely compromised when an out-of-area appraiser can step in and blow up a transaction.

So is this a good thing or a bad thing? Are regulators protecting us from ourselves or are they preventing the market from recovering?

In our sphere, we've heard innumerable stories of local appraisals being done by out-of-area appraisers. (Mill Valley house, Sacramento appraiser. San Francisco condo, Morgan Hill appraiser.) We talk often about the importance of working with a Realtor who really understands a local market. Well, that wisdom gets severely compromised when an out-of-area appraiser can step in and blow up a transaction.

So is this a good thing or a bad thing? Are regulators protecting us from ourselves or are they preventing the market from recovering?

Labels:

Appraisals,

lending,

local knowledge,

mortgage,

Property values

The Biggest Investment That Isn't

Apropos of today's earlier post, we were thinking about the conventional wisdom that one's home is usually one's largest investment. In light of the number of people walking away from their "largest investment," it's worth asking...if a person buys a home with zero down and an interest-only loan (as was the case for more than a few buyers during the boom time), is it really an investment at all? The only thing the buyer is risking is his credit score. There's no judgement or political statement implied by the previous sentence. Just an observation meant to spark debate.

Labels:

Bank-owned,

Foreclosures,

Home Values,

mortgage,

Property values

Who's At (De)Fault?

An interesting article in today's Chron raises the questions about what happens when defaulting on debt no longer carries much of a stigma. Up to 25% of foreclosures are occurring because homeowners simply walked away from their home; something what was all but unthinkable for previous generations. For those with a talk radio viewpoint on this subject, the piece makes the notable point that it's not just individual homeowners who are walking away from financial obligations. Developers are abandoning multi-million dollar projects. And, of course, we all know about the Wall Street bailouts, which resulted from similarly reckless behavior, with consequences softened only by the government's golden trampoline. We'd be interested in hearing what readers think about everyone from homeowners to Wall Street brokerages getting into trouble from which they cannot recover. Has fiscal accountability become a national afterthought? And if so, is this a temporary phenomenon or a permanent shift in how Americans view debt and risk? Can the shame of being a welsher ever be recaptured? (I'm one quarter Welsh, so I think I can use that word.) Should it be?

Labels:

Bank-owned,

mortgage,

REO

Friday, February 19, 2010

Money Train

Another update on the progress of the SMART train. In case you're wondering why we keep reporting on this story, we believe that the SMART train (whether it makes it to the station or not) will have a big impact on North Bay real estate.

Clean Bill of Health

In possibly the least shocking news story of the year, Marin was recently ranked as as California's healthiest county. It's a very nice sustainably harvested feather in our organic hats. Laugh all you want, but these are the things that help real estate values. We plan to celebrate with a Double Double and a side of fries.

Labels:

local knowledge,

Marin,

Marin Real Estate,

Property values

Rubber-necking Real Estate

Sometimes it's hard not to look. If you're curious to know more about foreclosures in Marin, check out the IJ's forclosure database. Please note, however, that while this information is public, it's also personal. Let decency prevail. You should also know that many home listed as "in the foreclosure process," will never become bank-owned. These days, most people attempting to do loan modifications are being advised to go into default on their mortgages. This starts the foreclosure process. In many of these cases, the lenders will modify the loan before the house is reposessed and the owners will remain in possession.

Labels:

Bank-owned,

Foreclosures,

Marin,

Marin Real Estate,

Notice of default,

REO

Monday, February 15, 2010

What's Your Point?

In today's Chron, various parties weigh in on what will happen to mortgage rates in the coming months. Of course, to borrow from William Goldman, "Nobody knows anything." Nevertheless, speculation that rates could jump as much as a full point should give some pause to anyone with a stake in real estate. Higher rates usually mean falling values. With apologies to Mr. Goldman, one thing we do know is it's going to be a very interesting year in real estate.

Posted by Jess Pearson

Posted by Jess Pearson

Labels:

buying a home,

interest rates,

mortgage,

selling a home

Thursday, February 11, 2010

Rising Tide?

If a rising tide lifts all ships, then what do rising interest rates do? Unless, like us, you assiduously avoid television news and talk radio, you've already heard about Fed Chairman Bernanke's comments regarding eventual and inevitable increases in interest rates. Here's the article about it in the Times. When rates go up, lots of things will happen; some bad and some good and all depending one your point of view. But they won't all happen at once and they won't all happen right away. One thing we think we can say with relative confidence...if you're thinking about buying and you plan to hold on to your investment for a good long while, this might be the time to act. Conforming loan rates are under 5%. Even if prices fall, higher rates will mean higher cost of ownership over the long haul. Unless you're a cash buyer, you may look back on Q1 of 2010 as that rare moment when prices and interest rates were both low.

Labels:

buying a home,

interest rates,

lending,

mortgage,

selling a home

Wednesday, February 10, 2010

Orange You Glad I Didn't Say "Termite?"

Some of you know that we're huge fans of the San Francisco Giants. If you're like us, you love to listen to their games on the radio. And if you listen, then you know that the Giants' flagship station, KNBR, runs a lot of ads for orange oil termite treatment. We've heard mixed reviews about orange oil, so we were happy to see a little Q&A in the Chron this week. We can't promise that this is totally accurate (it is the Chron, after all), but at least now you know more than you did before (or ever wanted to?) about orange oil.

Labels:

Home maintenance,

Inspections

Thursday, February 4, 2010

Default Setting

Marin IJ or SF Chron: two sources for the same info. Notices of default were down last quarter, but we're not ready to draw any conclusions yet. There are too many forces at play in the marketplace right now to say whether a trend can sustain.

Labels:

Bank-owned,

Bay Area Real Estate,

Foreclosures,

REO

More on the SMART Train

The IJ had another update on the SMART train. Looks like a modified route is a possiblility. From where we sit, it's hard to get behind any option that doesn't include a connection at the Larkspur Ferry Terminal. How do other North Bay residents feel?

Labels:

local knowledge,

Marin,

Marin Real Estate

Wednesday, February 3, 2010

Slow Train Coming?

For those who missed it, here's an update on the SMART Train that will connect Marin and Sonoma Counties.

Posted by Jess Pearson

Posted by Jess Pearson

Labels:

local knowledge,

Marin,

Marin Real Estate

Subscribe to:

Posts (Atom)